idaho sales tax rate in 2015

You may need a Sales Tax Certificate if any of the following apply your business. Public School Finance at the Idaho State Department of Education prepares payments for districts and creates school district financial data reports.

State Corporate Income Tax Rates And Brackets Tax Foundation

Details Analysis of.

. Taxes including state or local sales taxes that are paid or incurred in connection with an acquisition or disposition of property these taxes must be treated. Statewide Certified Staff Salary Summary. 0 3 Some local jurisdictions do not impose a sales tax.

A special sales tax on alcoholic beverages was repealed in 2010. Average form completion time. For distributions after December 6 2015 a REIT is generally ineligible to participate in a tax-free spinoff as either a distributing or controlled corporation under section 355.

2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 Calculate your tax rate based upon. Business purchases for resale are also exempt with the use of a Sales Tax Resale Certificate Form ST-4 completed by the buyer. The sales tax jurisdiction name is Chicago Metro Pier And Exposition Authority District which may refer to a local government division.

Hotel motel and campground accommodations are taxed at a higher rate 7 to 11. 0 05 Some local jurisdictions do not impose a sales tax. Tax is collected by the Idaho State Tax Commission.

You can collect the 7 state rate and add 225 to all purchases meaning you would charge a flat 925 rate to all Tennessee buyers. An alternative sales tax rate of 105 applies in the tax region Snohomish-Ptba which appertains to zip code 98204. An alternative sales tax rate of 106 applies in the tax region Mill Creek which appertains to zip code 98208.

98201 98203 98206 98207 and 98213. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 825.

Taxidahogovindrate For years. The Everett Washington sales tax rate of 99 applies to the following five zip codes. New Mexico reduced its sales tax rate from 5125 percent to 5 percent.

2020 Idaho Association of School Business Officials IASBO Spring Workshop. You can print a 1025 sales tax table here. Likewise if you buy camera equipment in Idaho where the sales tax rate is 6 and your local sales tax rate is 82 you owe a 22 use tax.

Tax Foundation is Americas leading independent tax policy resource providing trusted nonpartisan tax data research and analysis since 1937. Practically speaking few consumers pay a use tax unless the purchase is of a car or truck where a use tax must be paid before the vehicle can be licensed. Texas has 2176 special sales tax jurisdictions with local.

Clothing has a higher tax rate when you spend over 175and a special local sales tax of 075 may apply to meals purchased in some localities. 5 minutes to complete form. Sales tax rate differentials can induce consumers to shop across borders or buy products online.

Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax. 2022 Sales Tax Holidays. The 1025 sales tax rate in Chicago consists of 625 Illinois state sales tax 175 Cook County sales tax 125 Chicago tax and 1 Special tax.

Imports for consumption are taxed at the same rate as the sales tax. Educational Guide to Sales Tax in Idaho. Some jurisdictions impose local option sales tax.

Shipping is taxable if items are taxable. Average Fuel Mix 20112015 As of. Texas Sales Tax Rate Tables.

The sales tax was introduced at 3 in 1965 easily approved by voters where it remained at 3 until 1983. You can either collect the sales tax rate at the buyers ship-to address for all orders shipped to Tennessee ie destination-based sourcing. Prescription Drug Legislation.

Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. The state has reduced rates for sales of certain types of items.

How Do State And Local Individual Income Taxes Work Tax Policy Center

The Sales Tax Is Not Automatically Being Added To My Client Invoice How Can I Fix This

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Littourati Main Page Blue Highways Moscow Idaho Idaho County Idaho Travel Idaho Adventure

How To Charge Your Customers The Correct Sales Tax Rates

Cash Rich States Are Slashing Taxes Amid Revenue Windfalls

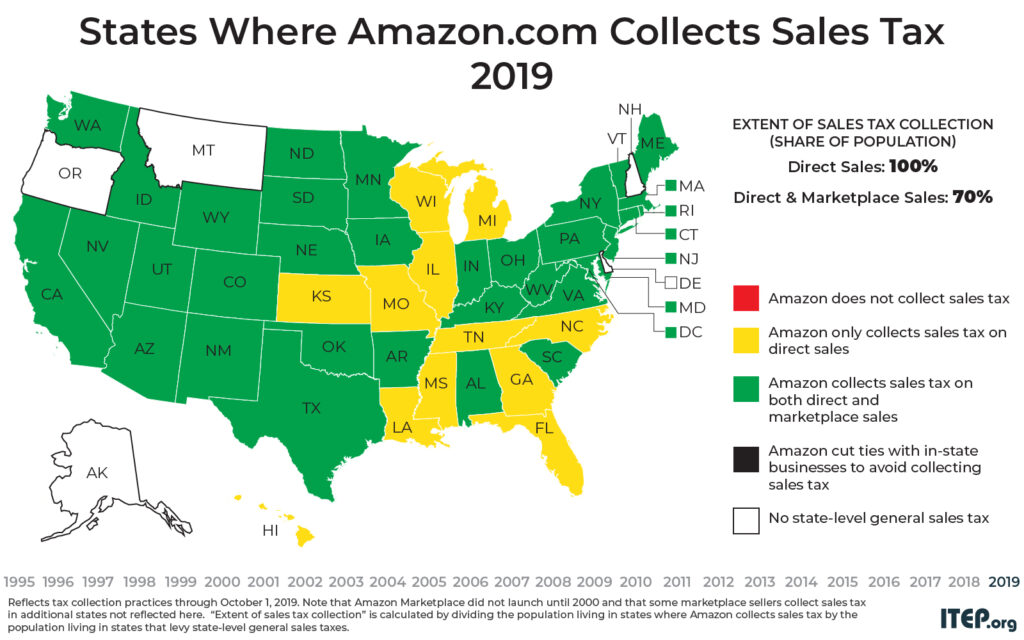

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

The Sales Tax Is Not Automatically Being Added To My Client Invoice How Can I Fix This

Indiana Income Tax Rate And Brackets 2019

How To Charge Your Customers The Correct Sales Tax Rates

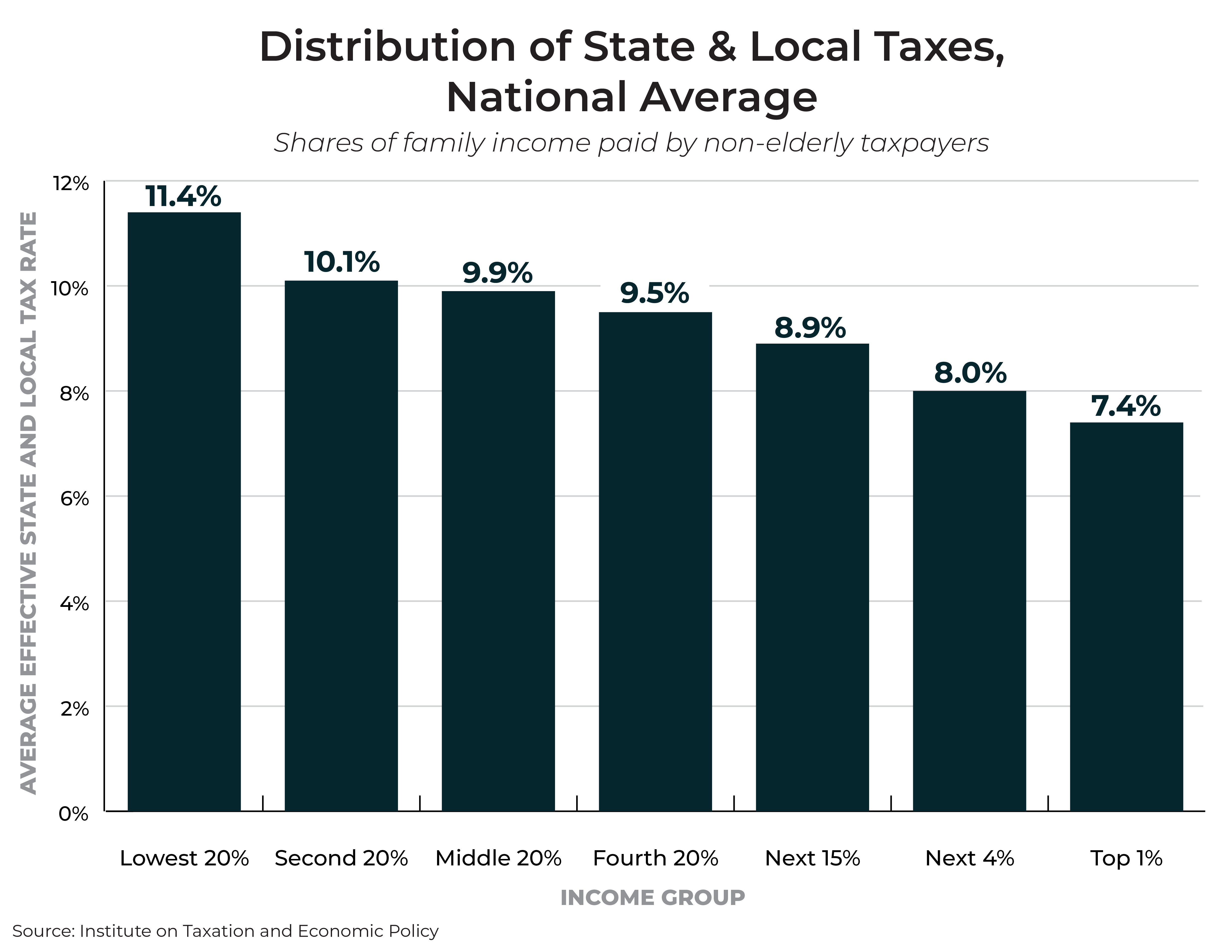

Fairness Matters A Chart Book On Who Pays State And Local Taxes Itep

How To Charge Your Customers The Correct Sales Tax Rates

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Interest Mortgage

State Corporate Income Tax Rates And Brackets Tax Foundation

Combined State And Local General Sales Tax Rates Download Table